- October 28, 2022

- Posted by: pragma_admin

- Category: Uncategorized

In the advent of Ukraine-Russian war, the global economy has faced a turbulent time in terms of inflation, war induced drought, a recession in individual economies and last but not least, shortage and production cuts of petroleum.

OPEC+ countries made their second meeting after COVID-19 outbreak in October, 2022 where they agreed to cut 2 million barrel per day (bpd) causing a 4.5% in price surge that will be experienced as of November 2022. When compared to the previously held agreement in 2020, it saw a 2% increase. At its current capacity, it is producing 3.58 million barrels a day which is below its intended target and only addressing up to 3.5% of the global oil demand itself.

Depending on the contents of sulfur, its location and level of difficulty for extraction, the price of oil in international oil trade and market is divided based on two major grades. These are the Brent crude and WTI grades. The Brent oil is produced at oil fields and North Sea sites. It is also called “sweet crude” as its content of sulfur is less than 1% making it easily extractable from the sea with less infrastructure to transport it from the site to intended buyers. This price benchmark is what is most commonly used by Europe, Africa and Middle East.

While the WTI, a short for West Texas Intermediate is extracted from and a benchmark used mainly by North America. While the Asian countries use the Dubai/Oman benchmark that came into operation as of 2017. It is also called “sour crude” due its higher density of sulfur and time it takes to extract from mainland and deliver to the buyers in international trade where it is also exchanged.

These standards came into existence after the 1970s, as traders opted for a pricing mechanism that could fix the fluctuation of crude oil prices ahead in time of future purchases. Prior to the 1970s, crude oil buyers would come to purchase but the prices were determined on the spot, and it experienced massive fluctuations of future prices. As a result, traders came to the agreement to form a benchmark that could grade pricing.

Currently there are two major blocks of crude oil producers/extractors that are trading crude oil, namely the OPEC+ and the Shale Oil of US. OPEC+ however have been the majority suppliers in the market comprising of two-third of the global demand for crude oil. While the Shale Oil joined the market after 2008 recession, it enjoyed surplus production that covered the internal demand in the US followed by a boom in global market up until 2018.

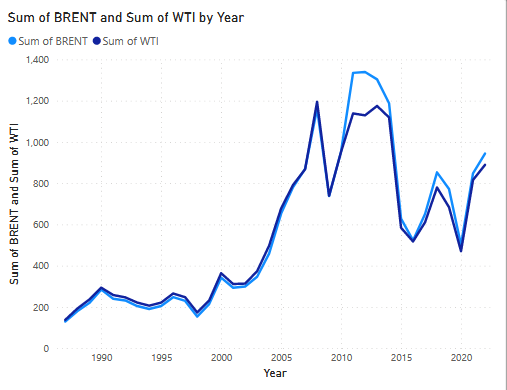

Since 1986 to 2011, the price of crude oil per barrel for both major benchmarks at the international market Brent Crude and WTI Crude was very close. The Brent Crude departed in its pricing completely after 2011 mainly due to geopolitical tensions such as Arab Spring causing a fear that the Suez Canal might be closed resulting in sudden price hikes for the Brent Crude as demand increased. As a result, the year 2011 saw the departure in price between Crude and WTI.

But not long after that, in 2016, both experienced a sharp drop where Brent Crude experienced a 4.11% fall in four years. The price of crude oil per barrel stayed $90 for three consecutive years from 2011 to 2014. Just after the economic recession, US shifted its reliance on imported fuel and focused on its Shale Crude production which reached surplus and went to the international market from 2014 to 2016.

During those years, the world experienced a decline in oil prices due to changes in oil export policies from OPEC countries. Thus, resulting in booming oil production levels for US Shale Crude and the competitive advantage over other suppliers as a result of fracking, a technological advancement of extracting Shale oil through hydraulic drilling, sand and chemicals to get the gas to the earth surface. One factor led to another and the OPEC exporting countries also increased production causing a surplus which means, decline in prices for the two benchmarks.

There could be many factors affecting the price of crude oil. It could range from geopolitics in oil production areas all the way to weather, like Hurricane that could disrupt production levels from extraction-

Source: St. Louis Fred Economic Data

ground to end users. But all these factors are secondary factors because what drives the major price hike or sharp fall is just how the secondary factors play over the two benchmarks, the Brent Crude and WTI Crude.

Ethiopia is a net importer of petroleum, refined extract of the crude oil from the Kuwait and Vitol of Bahrain. In 2018, the import of fuel accounted for 12 percent of the country’s merchandise imports. In the Ethiopian FY2014 year, from the overall allocated budget of 787 billion ETB, the Ethiopian Government has dedicated a 120 billion ETB to subsidize such imports. If countries empower innovative solutions to explore, extract, refine and produce, it could facilitate ways in saving billions of dollars especially for emerging and frontier market.